Photo by PoPville flickr user Mr. T in DC

Griffin & Murphy, LLP, is a boutique law firm in Washington, D.C. concentrating its practice in real estate law (including development, finance, leasing, zoning and condominium conversions), as well as estate planning and probate, civil litigation, and business law. The attorneys of Griffin & Murphy, LLP are licensed to practice law in the District of Columbia, Maryland and Virginia. Griffin and Murphy, LLP was founded in 1981.

Please send any legal questions relating to real estate, rentals, buildings, renovations or other legal items to princeofpetworth (at) gmail (dot) com, each week one question will be featured. You can find previous questions featured here.

Question:

Hi PoP,

We own a rowhouse in Columbia Heights, and rent out our 1BR basement apartment. Our tenants (past and current) have always signed a pretty basic 12 month lease with us, stipulating rent, portion of utilities, pets, etc… we don’t have separate utilities (they pay a portion) but they do have a separate front entrance. We share the laundry room in the basement. We do not have a certificate of occupancy for the basement, because the ceilings are a half foot too low for DC code. A pretty common arrangement in DC I think. My question is about our taxes: last year our rental income from the basement came to just under $12,000, so we reported it as miscellaneous income on our DC return. It is my understanding that income over $12,000 must be reported as a business income, or something else other than misc. I fully expect that in 2010 we will make more than $12,000 from the basement, so how should I report it on my returns? An accountant friend of mine says we should just make sure we keep our income from it under $12K, but we can probably do much better than that (and we really need the cash). He also thinks that if we report it as tenant income, then DC might investigate and see that we don’t have a C of O. Of course, we do not want to cheat on our taxes but at the same time we want to minimize them as much as is legal. Finally, I have heard some people say that we could list it as ‘housemate’ or ‘roommate’ income, rather than as ‘tenant’ and avoid some of the reporting requirements. Do we have any choices aside from capping our income at $12,000 or but to taking a tax hit and risking DC govt getting angry at us?

Thanks,

A landlord

PS: I’m sure that many people will claim I’m an evil gentrifying jerk, but I’ve been here for over ten years and have spent a lot of time, money, and energy not only fixing up our house but also keeping the neighborhood clean and being actively involved in it. And, in the end, it’s our house and I see nothing wrong with renting out some of it to help us make ends meet.

Answer:

Dear Landlord:

There are probably hundreds if not thousands of unlicensed basement apartments in the District of Columbia. These basement apartments are often referred to as “in-law suites” because there is no Certificate of Occupancy available for the basement apartment and, if the apartment is not code compliant, none can be obtained. Without a valid Certificate of Occupancy, no Housing Business License can be obtained and the rental unit cannot be registered with the Rental Accommodations Commission. This also means that the landlord cannot request an exemption from the rent level limitations imposed by the rent stabilization laws in the District. Continues after the jump.

People who rent out these apartments usually do so out of necessity because they need the income; however, they do so at their peril because what they are doing is illegal. If someone leases an illegal basement apartment, they have to be prepared for the consequences if they are caught. Here are some of the problems such a landlord might face:

1. Rent roll back because the basement apartment is not exempt from rent control.

2. Civil enforcement action by the DC Government seeking to stop the use and penalize the landlord with civil fines.

3. Problems with insurance coverage. Most landlords don’t tell their insurance carrier that their rental unit is not legal. However, if something happens to the unit, or worse, to the occupants of the unit, there may be no insurance coverage.

4. Possible difficulty in using the courts to evict a non-paying tenant because the landlord has no Certificate of Occupancy, no Housing Business License and no Rent Control Exemption Certificate.

If the basement unit is physically connected to the upstairs by an internal staircase, then the landlord might take the position that his tenants are really roommates. However, there is no guaranty that such a position would be upheld, especially if there was a lease describing the basement apartment as a separate rental unit.

Given all of these problems, why would anyone want to rent out an illegal basement apartment? There are several reasons:

1. Economic necessity.

2. Lack of enforcement of the laws pertaining to these apartments.

3. The general need of the community for affordable rental units in good locations.

If a property owner is going to rent an illegal basement apartment, the owner should at least be aware of the possible consequences as well as the obvious benefits.

We are not able to comment on the tax consequences associated with how this income is reported. This is a question best answered by a competent CPA or a tax lawyer.

This response was prepared by Mark G. Griffin and Patrick D. Blake of Griffin & Murphy, LLP. The material contained in this response has been prepared for informational purposes only and should not be relied upon as legal advice or as a substitute for a consultation with a qualified attorney. Nothing in this response should be considered as either creating an attorney-client relationship between the reader and Griffin & Murphy, LLP or as rendering of legal advice for any specific matter.

Recent Stories

Photo by Clif Burns Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Hey – you stopped me while…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

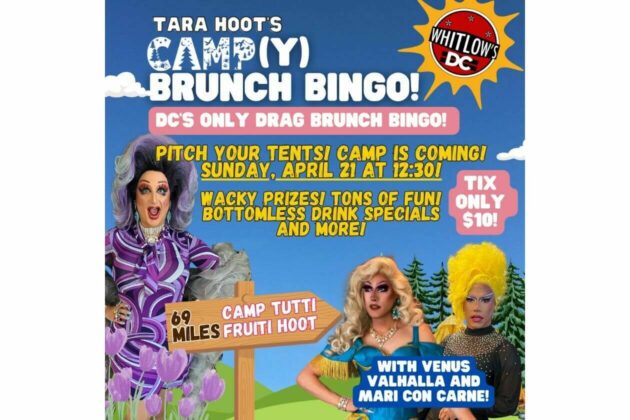

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3: